Since investigation results on problems in SMKOR (March 2023) were published, the Council has been constantly tracking changes in the VAT system, as well as their impact on business. The Council maintains communication with the Ministry of Finance and the State Tax Service, raising questions regarding specific steps to eliminate deficiencies in SMKOR and improve interaction of tax bodies with taxpayers.

During the last year the Council noted significant incremental changes:

– Administrative appeal of decisions on riskiness of a taxpayer and refusal to accept data tables introduced (a BOC recommendation issued in 2019 finally taken into account)

– Analysis and legislative changes forecasting functions improved which contributed to decreasing the number of tax invoice suspensions

– The Verkhovna Rada of Ukraine involved in getting feedback on business proposals

– The form of decisions on taxpayers’ riskiness and non-acceptance of data tables improved

– The period during which transactions are taken into account when considering riskiness of the taxpayer limited to 180 days

– Positive tax history indicators list expanded

– Work on the taxpayer’s profile started

– Created regional communication platforms and “hot lines” for taxpayers and public organizations.

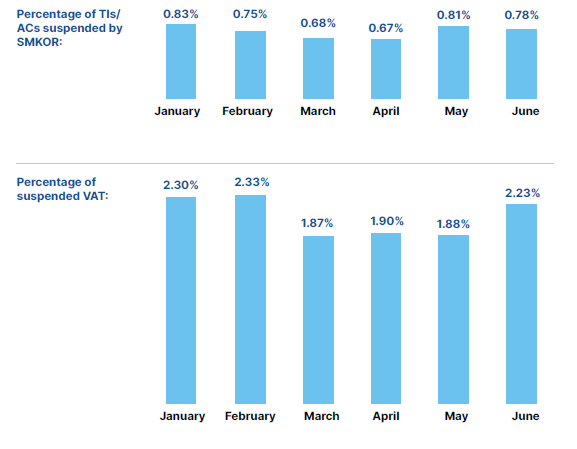

However, despite moderate formal changes, taxpayers still remain firmly in the sights of tax

officials in terms of SMKOR operation and inspections. A positive trend towards TIs/ACs reduction that we observed during Q1 2024, faltered in Q2. As a result, in June, the number

of suspended TIs/ACs (0.78%) almost returned to the January level this year (0.83%), and the amount of blocked VAT in June (2.23%) almost reached January-February indicators this year (2.30%, 2.33%, respectively). We are going to present a more thorough analysis after receiving additional statistical information from the STS of Ukraine in months to come.

In Q2 2024, according to the Council’s observations, there is a trend of including enterprises in risky taxpayers’ lists and non-acceptance of data tables mainly based on formal insufficient (according to the tax office) tax burden of both VAT and income tax. Meanwhile, in decisions on refusal to exclude from the risk list and accept data tables completely different grounds are often specified, resulting in their successful appeal in courts.

Which recommendations remain relevant for fixing the SMKOR system, read in the quarterly report.